How an Economic Recession Resembles a Bad Mood

Whether one is near, far, or perhaps already here.

To put recessionary concerns in perspective, it might help to describe a few ways a recession resembles a bad mood. There are some intriguing similarities!

1. There Is No Precise Definition.

We all know what a bad mood feels like. But there is no clear definition for a mix of real and perceived setbacks, and how they’re going to affect us.

In the U.S., the National Bureau of Economic Research (NBER) defines a recession as follows:

“A recession is a significant decline in economic activity that is spread across the economy and that lasts for more than a few months.”

Rather vague, isn’t it?

2. You Usually Can’t Spot One Except in Hindsight.

How do you know when you’re in a bad mood? Often, you don’t, until you’re looking back at it.

Recessions are similar. Since a widespread downturn must linger before it qualifies as a recession, the NBER only declares one after it’s underway. In July 2020, the NBER announced we’d been in a recession for two months between February–April 2020. This was triggered, of course, by the arrival of the global pandemic. The recession was over by the time we officially acknowledged it.

3. Sometimes, We Get Stuck for a While.

Hopefully, your bad moods come and go. But sometimes, one misfortune feeds another.

In similar fashion, recessions can become a self-fulfilling prophecy. As Nobel Laureate Robert Shiller describes, “The fear can lead to the actuality”. When this occurs, the financial fallout may last longer than the underlying economics alone might suggest.

4. They’re Inevitable.

It’s never fun to be in a bad mood, but they’re part of life.

Similarly, nobody celebrates a recession. But it helps to recognize they aren’t aberrations; they are part of natural economic cycles.

For example, we may enter into a recession (or already be in one) as a byproduct of interest rate increases aimed at warding off rising inflation. If we can avoid a recession, all the better. But if it’s going to take a modest one to reduce inflation, it may be the preferred choice.

5. Experience Helps.

When we’re youngsters, we might not realize we won’t be miserable forever just because we’re unhappy in the moment. As we mature, we learn to temper our moods and seek support.

The same can be said about recessions. It’s been more than a decade since the Great Recession; and more than 40 years since the U.S. last experienced steep inflation. It may help to acknowledge we’ve been here before. By our count, there have been 17 “bear markets” since 1926—an average of one every five years or so.

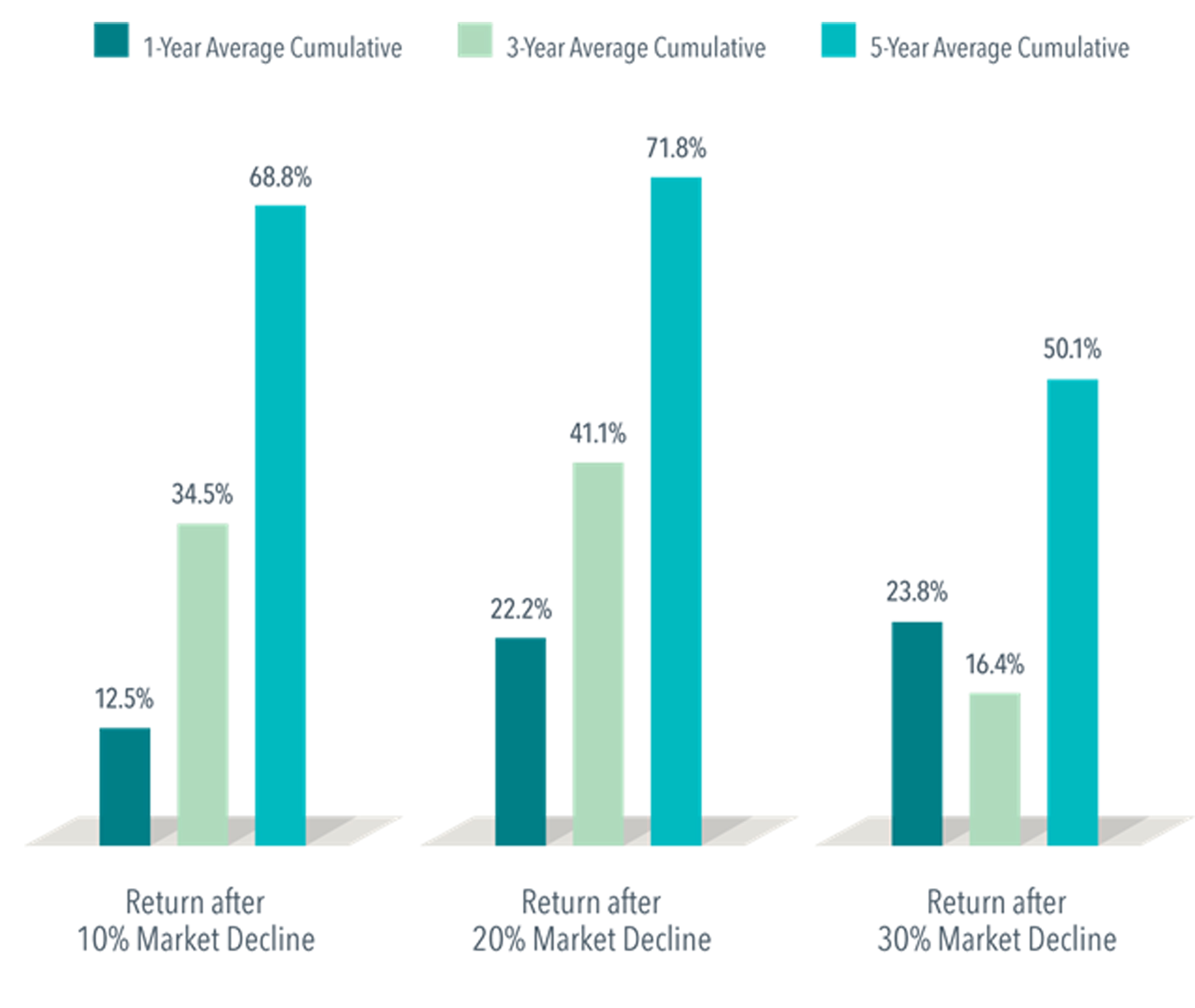

It may also help to remember: Every recession has eventually ended, and brighter days followed. As the image below summarizes, cumulative returns after U.S. stock market declines have all been strongly positive.

6. You Can’t Change Others, But You Can Change Yourself.

When you’re in a funk, it doesn’t matter whether it’s due to one or many unfortunate events, or “just because.” There’s ultimately only one person who can change your mood: yourself.

The same is true for your response to recessions, bear markets, and other external events standing between you and your financial well-being.

Sometimes all it takes is a shift in sentiment to seize your next best move.

As always, we’re available to assist with that in any way we can.

Don’t hesitate to be in touch at www.openwindowFS.com/connection.