Big Hat, No Cattle

By Eric A. Hollen, CFP®, AIF

& Joe Hollen, MD, CFP®, AIF

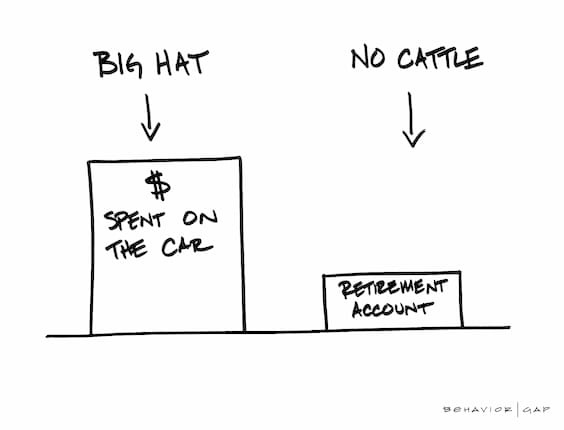

We have a saying out here in the West: “Big Hat, No Cattle”.

It refers to someone who is all talk, and no action. For us, it refers to someone who earns a high income but is unlikely to save much. After all, it’s not what you make, but what you keep.

Our clients tend to be both High Earners and Good Savers. They’ve spent a lot of time developing these habits. They don’t want their efforts ruined by a bad market, a bad government, bad advice, or an unlucky roll of the dice.

Here are a few concerns that we’re hearing from them.

Concern #1: The Tax Code

High-Earners & Good Savers pay a large share of the taxes that support our government. Depending on the political party in power, we could see changes in the tax code that might:

- Return the top income tax bracket to pre-1980 levels of between 70% and 90%

- Remove beneficial deductions, such as for retirement savings

- Increase estate taxes

Concern #2: A Volatile Market

Most High-Earners & Good Savers are invested in public companies that can help offset inflation and continue to grow. They might also be heavily invested in their own private businesses. During a market crash, their net worth could drastically shrink. Without a solid investment strategy that incorporates all their assets, poor diversification and concentration could permanently impact their net worth.

Concern #3: Retirement

High-Earners are not automatically Good Savers. Consider the late start many physicians experience, often not earning a significant income until their thirties. They might also face a pile of student debt, plus lifestyle expectations including homes, cars, or the financial support of others. Earning a lifetime of income in a short time means making a lifetime of financial decisions just as quickly, but with less room for mistakes.

Concern #4: Insurance

High-Earners & Good Savers face unique risks, like the threat of litigation, or the risk that a health problem could end their careers. Malpractice insurance, disability and life insurances, and umbrella insurance are necessary, but must be purchased prudently. Unfortunately, many sales are based on a commission first, and the buyer’s needs second or third.

Concern #5: Estate Planning

High-Earners & Good Savers will naturally accumulate assets. Creditors have certain rights to come for those assets in order to satisfy a debt. Depending on the state, assets can be sheltered in retirement accounts or shielded in other ways.

Even in their death, the assets of the High-Earner & Good Saver find no respite. Inherited wealth can be a curse to those that are unprepared to receive it.

Plus, the federal government seeks a cut if an individual’s estate exceeds ~$11 million. While $11 million is more than enough for many, in the early 2000s the same limit was $1 million. Estates in excess of the limit are taxed at a rate of 40%. When the limit is changing in orders of magnitude - $1 million versus $11 million - High-Earners & Good Savers are rightfully concerned.

Concern #6: The Wolf in Sheep’s Clothing

In the medical profession, physicians practice according to a familiar standard: “First do no harm.” It seems there should be a similar level of commitment for anyone who wants to advise you on your financial wellbeing, right?

Unfortunately, that’s not always true. Financial advice remains subject to harmful double standards. That is why Open Window exists: to be a stronghold for your family’s finances.

HERE IS HOW TO FIND GOOD ADVICE.

https://openwindowfs.com/insight/finding-your-fiduciary-financial-advisor